Bregal Sphere

24 Feb 2026

Bregal Investments (“Bregal”), a leading private equity investment firm, today announced the launch of the Bregal Sphere Nature strategy – a dedicated natural capital strategy focused on investments in high-quality nature-based solutions (“NbS”) – and the appointment of Agustin Silvani, former head of Conservation Finance at Conservation International, who will serve as joint Managing Partner, alongside Alvar de Wolff.

Agustin brings with him extensive experience in natural capital investments and a wide network of corporate partners that will help enable the team to build a high-quality pipeline of investable projects and support the development of a high-integrity Voluntary Carbon Market. Under his leadership, Conservation International became a prominent force in natural capital investing, successfully raising and deploying over $1bn with partners through various financial mechanisms to help safeguard and restore vital ecosystems across the globe. Agustin is also a founding Board member of the Integrity Council for the Voluntary Carbon Markets (“ICVCM”).

Agustin Silvani

Managing Partner - Bregal Sphere Nature

Alvar de Wolff

Managing Partner - Bregal Sphere Nature

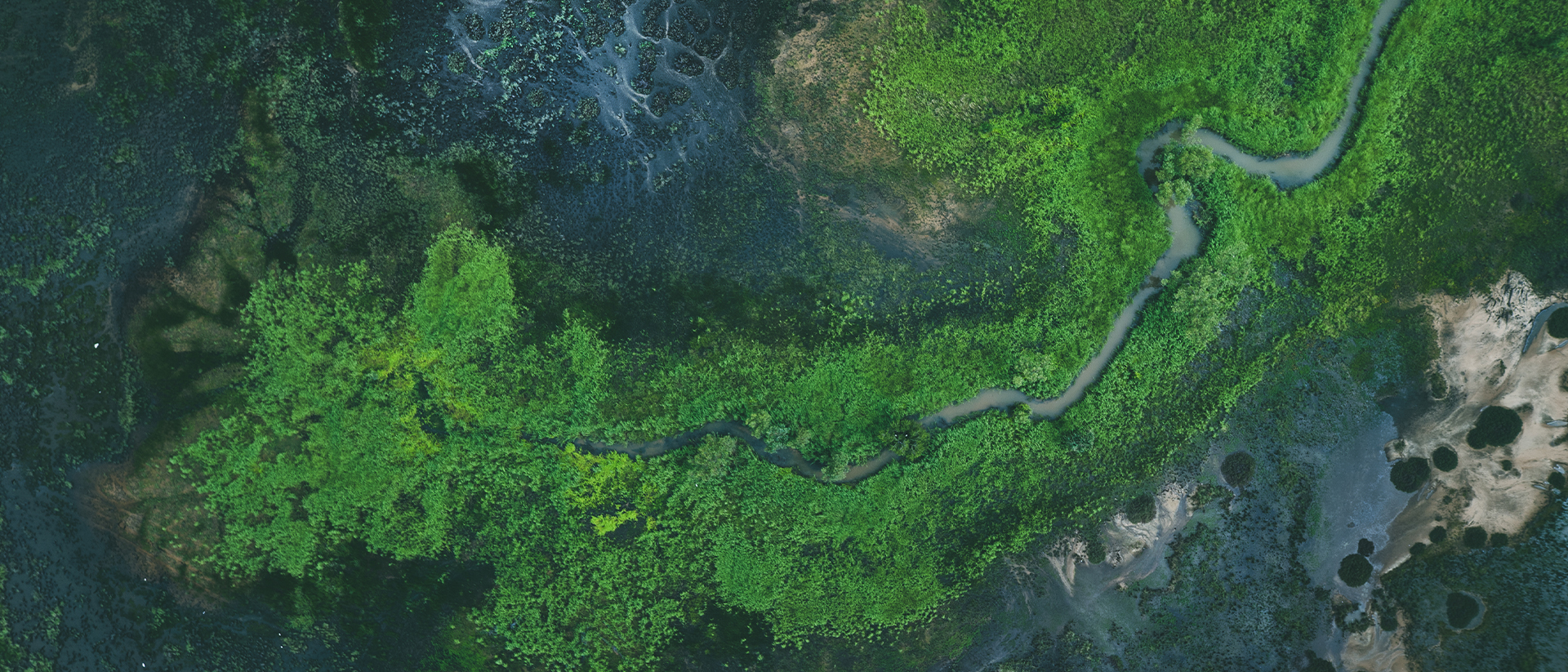

Through strategic partnerships with project developers, the Bregal Sphere Nature team will aim to deploy capital into genuine, high-integrity NbS projects that protect and restore nature, address climate change and biodiversity loss, and improve livelihoods for local communities. Bregal Sphere Nature will focus on long-term project investments within agricultural supply chains, such as coffee and cocoa agroforestry models. The strategy will also invest in high-quality reforestation projects in adjacent landscapes and mangrove restoration projects. By focusing on agricultural supply chains, it will seek to support corporate partners to achieve SBTi Forest, Land and Agriculture (“FLAG”) targets through insetting.

Alain Carrier

Chief Executive Officer - Bregal Investments